History of venture capital

History of venture capital

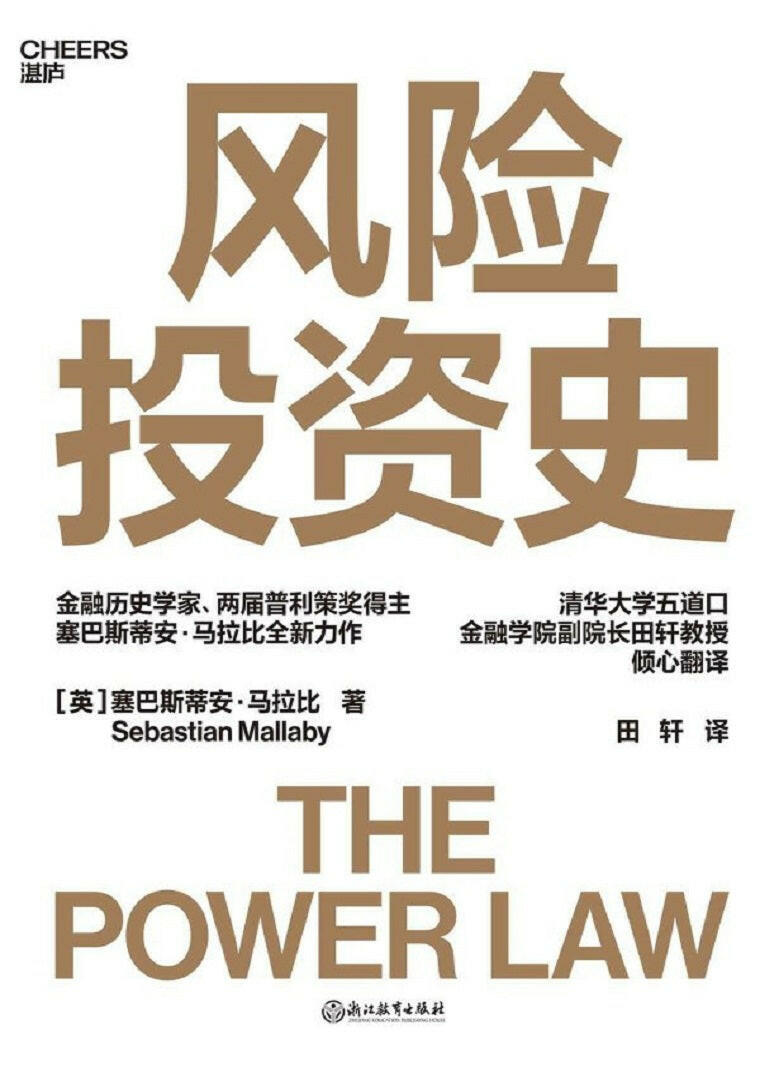

作者: [英] 塞巴斯蒂安·马拉比 出版社: 浙江教育出版社

Couldn't load pickup availability

Introduction

This is the true story of venture capital. In many people's impressions, venture capital has always been a mythical existence, holding the code to change the wind direction and create huge wealth. This book can help you open the mythical shell of venture capital, like a wormhole through time, and peek into the secrets of human nature, times, wealth and even the good and evil of capital. It interweaves the stories of legendary Silicon Valley companies and figures with insights into the development of the venture capital industry, and authoritatively reveals for the first time the reality of the hundreds of billions of capital operations behind the exponential technological revolution in Silicon Valley.

It reveals the fundamental principle that drives the venture capital industry, the entire Silicon Valley, and even the entire world - the law of exponentiation. The biggest secret of venture capital is that the best investments generate returns that equal or exceed the sum of the returns of the rest of the fund. Although success is rare, the impact of success is transformative. For this reason, venture capitalists always have extraordinary insight and intuition, a preference for risk and tolerance for failure. They dare to bet big in the face of huge uncertainties. For them, those seemingly crazy dreams, the bolder and the more impossible they seem, the more valuable they are. Venture capital is not just a business, but also a method, a way of thinking and a philosophy that can bring social progress. It can better meet human needs and desires by boldly supporting brave innovators. It can even be said that venture capital itself is a huge innovation.

Share